|

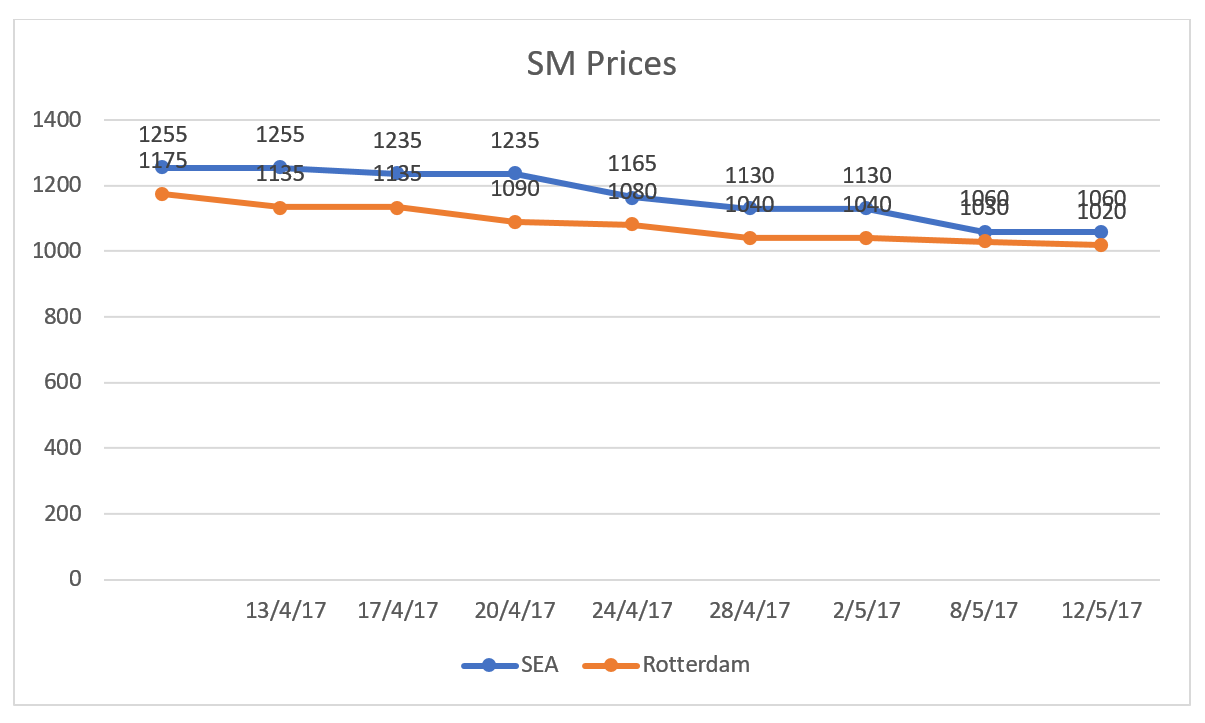

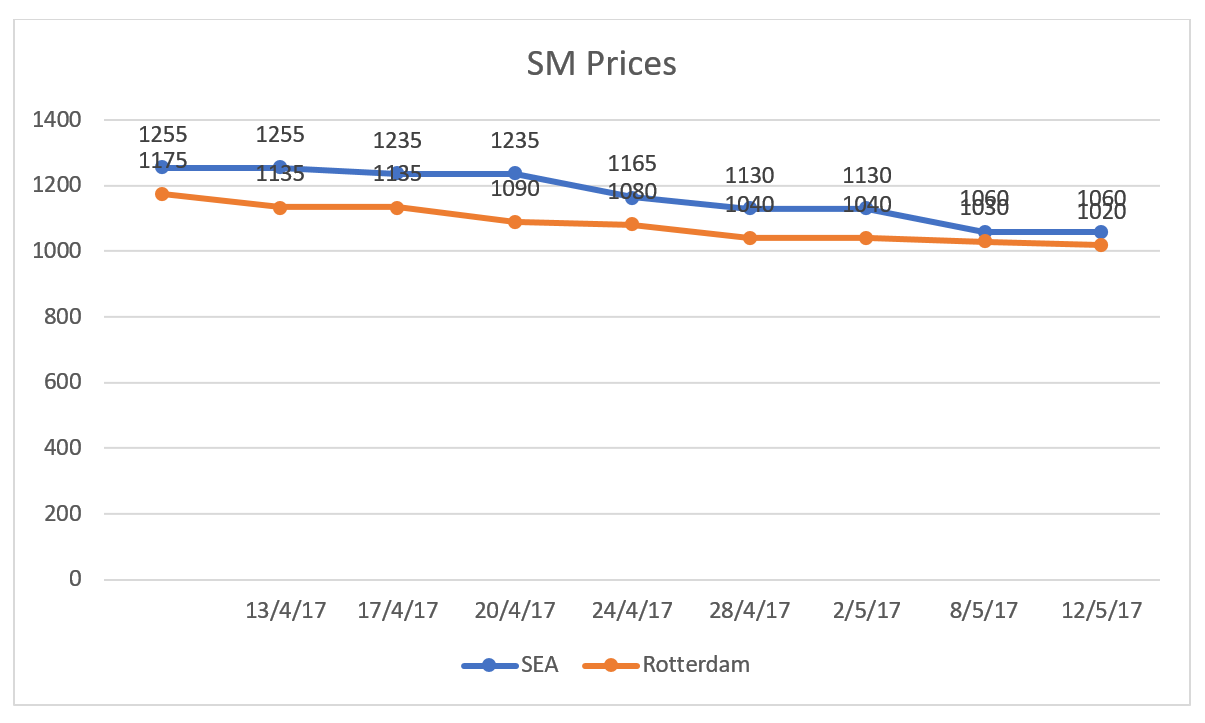

SM on 12th May 2017:

|

PS on 12th May 2017:

|

|

FOB Rotterdam at USD1,020

|

CFR China at USD1,200

|

|

CFR SEA at USD1,060

|

CFR SEA at USD1,170/MT

|

On 10th May, Styrene Monomer (SM) prices inched down again. Prices fell mainly of lack buying interest in major markets coupled with a fall in upstream benzene rates.

Benzene prices assessed down at USD700/MT FOB Korea, decline USD10/MT from 9th May. The price falls due to dull demand across the Asian region.

Ample product availability, weaker upstream energy and benzene rates coupled with bearish cues from the Asian SM values, forced sellers to reduce their prices sharply lower across the European & Asian regions. Weak downstream product demand and pricing trends further supported the price fall.

|

SM on 13th April 2017:

|

PS on 13th April 2017:

|

|

FOB Rotterdam at USD1,135/MT

|

CFR China at USD1,310/MT

|

|

CFR SEA at USD1,255/MT

|

CFR SEA at USD1,330/MT

|

Production News

· DFE Chemical delays the restart of PS plant

DFE Chemical has postponed the restart of polystyrene (PS) plant until next month. A Polymerupdate source in Philippines informed that the company has delayed the restart of the plant until mid-June 2017. Earlier, the plant was expected to be back online in mid-May 2017. The plant was shut for maintenance in first half April 2017. Located in Manila, the Philippines, the plant has a production capacity of 30,000 mt/year.

· Taiwan’s Kaofu Chemical to shut HIPS line

According to sources close to the company, Taiwan’s Kaofu Chemical Corporation will shut its 50,000 tons/year HIPS line at the end of May due to a planned maintenance that is expected to last for 2-3 weeks. The company’s PS plant has a production capacity of 50,000 tons/year of GPPS and 50,000 tons/year of HIPS while both lines are currently operating at 60% capacity.

· Asahi Kasei to shut Mizushima cracker

Asahi Kasei, Japan is likely to undertake a maintenance turnaround at its cracker today. A Polymerupdate source in Japan informed that the company is expected to shut the cracker for maintenance on May 10, 2017. The cracker is slated to remain offline until early July 2017. Located at Mizushima, Japan, the cracker has an ethylene production capacity of 570,000 mt/year

· China's Zhejiang Yisheng shuts PTA plant in Ningbo

According to market sources, China’s Zhejiang Yisheng Petrochemical had to shut its 650,000 tons/year No 2 PTA line at Ningbo on May 5 due to poor margins.

Also, the company’s 650,000 tons/ year No 1 PTA line has reportedly been offline for many years. The company, however, has two other PTA plants at the same location with a combined capacity of 2.2 million tons/ year, one of them which is planned to be shut in the middle of May due to a maintenance that will last for 10-15 days.

· China’s BP Zhuhai to take PTA plant offline

According to market sources, China’s BP Zhuhai Chemical Co. Ltd. Is planning to take its PTA plant offline in June due to a scheduled maintenance which is expected to last for three weeks. The plant has a production capacity of 1.25 million tons/ year of PTA.

· Production updates on S. Korean Hanwha and Lotte's styrene plants

According to market sources, South Korea’s Hanwha Total Petrochemical resumed its styrene production at its 400,000 tons/year No 1 styrene plant at Daesan after a planned maintenance that lasted for twenty days.

Meanwhile, South Korea’s Lotte Chemical will shut its 580,000 tons/year styrene plant at Daesan next week due to a scheduled maintenance which is expected to last for a month.

· Indonesia’s Polychem takes MEG plant offline

Market sources reported that Indonesia’s Polychem shut its No 1 MEG plant in Merak due to a scheduled maintenance at the end of April. How long the maintenance at the 96,000 tons/year plant will last is not yet known. The company also has another MEG plant with a capacity of 145,000 tonnes/year, which will be running normally during the maintenance period.

· PVC producers in China preparing for shutdowns in May-June

A source from an acetylene based PVC producer in China reported the schedule of maintenance shutdowns at several PVC plants in May-June 2017.

Yibi Tianyuan’s acetylene-based PVC plant with a production capacity of 380,000 ton/year of PVC was shut on May 3 for 7 to 10 days.

Yangmei Hetong shut its acetylene-based PVC plant with 300,000 tons/year for maintenance on May 5 while it is expected to restart on May25.

Qilu Petrochemical will shut its 250,000 tons/year ethylene based PVC plant on May 15 for 40 days.

Baotou Haipinmian’s 400,000 tons/year acetylene based PVC plant will be shut in mid-May.

Yidong Dongxin will shut its acetylene-based PVC plant with 300,000 tons/year capacity for maintenance in mid-May.

Henan Lianchun’s 300,000 tons/year acetylene based PVC plant will be shut in late May.

Hebei Shenhua will shut its acetylene-based PVC plant with 260,000 tons/year capacity for maintenance in late May.

There are also several maintenance shutdowns that will take place in May; however, further details regarding the start of shutdowns and the durations are yet to be known.

Xinjiang Shenxiong will conduct maintenance at its acetylene-based PVC plant with 500,000 tons/year production capacity while Inner Shanlian will also shut its acetylene based PVC plant with a production capacity of 300,000 tons/year.

Inner Mongolia Yihua’s 300,000 tons/year capacity acetylene based PVC plant will be shut in May while Xinjiang Zhongtai will also shut its acetylene based PVC plant with 1.6 million tons/year capacity in the same month.

Sichuan Jinlu’s 240,000 tons/year acetylene based PVC plant will be shut in May along with the Yili Chemical’s 500,000 tons/year acetylene based PVC plant.

Meanwhile, the maintenance shutdown at Anwei Huasu’s acetylene-based PVC plant with a production capacity of 460,000 ton/year was postponed to June from May.

*Source from Polymerupdate & Chemorbis*