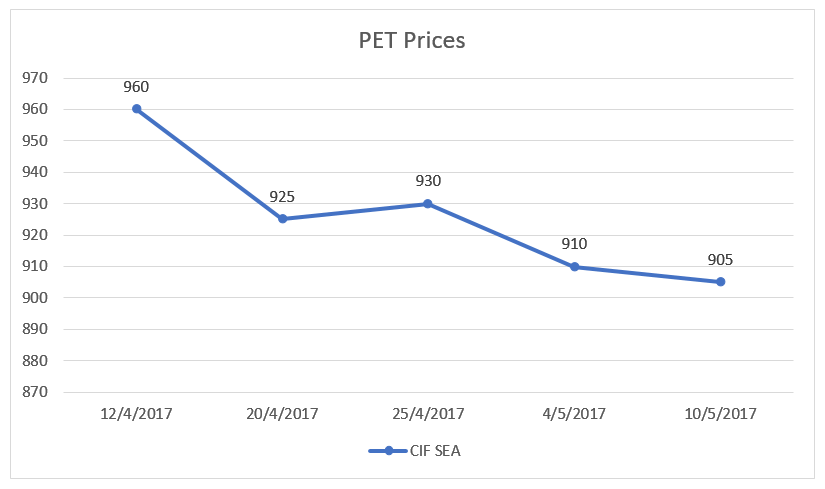

PET Market dips further in South East Asia

PET bottle grade prices dipped in Asia this week. Extremely dull buying interest with weaker upstream PTA rates supported the price fall.

In China, excessive production supplies from existing players, combining Wankai new PET plant further pressured prices even lower in Asia. Wankai new plant has a production capacity at 550KMT per annum.

Despite the start of high season in China, demand remains weak because buyers are not rushing to replenish their stocks and most of them are expecting the prices to drop further.

On 12th May, PET prices reported USD905 – 910/MT due to improved demand and a rise in PX feedstock value. China producers are optimistic about the demand will increase in May until July.

Production News

· MEG plant shuts by Sinopec Yanshan

Sinopec Beijing Yanshan Petrochemical Co Ltd has taken off-stream its monoethylene glycol (MEG) plant. A source in China informed that the company has shut the plant on May 11, 2017, ahead of Silk Road summit to be held on May 14-15 2017 in Beijing. The planned shutdown is expected to remain in force 8-10 days. Located in Bejing, China, the plant has a production capacity of 70,000 mt/year.

· China’s Zhejiang Yisheng shuts PTA plant in Ningbo

According to market sources, China’s Zhejiang Yisheng Petrochemical had to shut its 650,000 tonnes/year No 2 PTA line at Ningbo on May 5 due to poor margins. Also, the company’s 650,000 tonnes/year No 1 PTA line has reportedly been offline for many years. The company, however, has two other PTA plants at the same location with a combined capacity of 2.2 million tonnes/year, one of which is planned to be shut in the middle of May due to a maintenance that will last for 10-15 days.

· China’s BP Zhuhai to take PTA plant offline

According to market sources, China’s BP Zhuhai Chemical Co. Ltd. is planning to take its PTA plant offline in June due to a scheduled maintenance which is expected to last for three weeks. The plant has a production capacity of 1.25 million tonnes/year of PTA.

· Japan’s Mitsui Chemicals plans maintenance at PTA plant

Market sources reported that Japan’s Mitsui Chemicals is planning to shut its PTA plant at Iwakuni in September due to a scheduled maintenance.

The maintenance at the 400,000 tonnes/year plant is expected to last for a month, sources said.

· Indonesia’s Polychem takes MEG plant offline

Market sources reported that Indonesia’s Polychem shut its No 1 MEG plant in Merak due to a scheduled maintenance at the end of April. How long the maintenance at the 96,000 tonnes/year plant will last is not yet known. The company also has another MEG plant with a capacity of 145,000 tonnes/year, which will be running normally during the maintenance period.

· Shanxi MEG plant to be shut by Yangmei Shouyang

Yangmei Shouyang is in plans to take off-stream its monoethylene glycol (MEG) plant at Shanxi. A source in China informed that the company has scheduled maintenance at the plant on May 11, 2017. The plant is expected to be taken off-line for about 4 weeks.

Located at Shanxi in China, the plant has the production capacity of 220,000 mt/year.

· MEG plant to be shut by Sinopec Hubei

Sinopec Hubei Chemical Fertilizer is likely to undertake a planned maintenance at its monoethylene glycol (MEG) plant. A source in China informed that the company has scheduled maintenance at the plant in June 2017. The plant is expected to remain under maintenance from early-June 2017 until early-July 2017. Located at Zhejiang in Hubei province of China, the plant has a production capacity of 200,000 mt/year.

· PCG operates MEG plant at optimum levels

Petronas Chemicals Group (PCG) is presently running its monoethylene glycol (MEG) plant at 100% of production capacity rates following an unplanned outage. A source in Malaysia informed that the company has resumed operations at the plant in end-April 2017. The plant was taken off-line on April 13, 2017, owing to technical issues. Located at Kerteh in Malaysia, the MEG plant has a production capacity of 400,000 tonne/year.

· Ningbo PTA plant shuts for maintenance by FCFC

Formosa Chemical & Fibre Corp (FCFC) has undertaken a planned maintenance at its purified terephthalic acid (PTA) plant. A source in China informed that the company has started the turnaround at the plant on May 8, 2017. The maintenance is expected to remain in force for around 2 weeks. Located at Ningbo in Zhejiang province of China, the plant has a production capacity of 1.2 mt/year.

*Source from Polymerupdate & Chemorbis*